“My mother dreamt of running a chain of stores. This was in the eighties, when access to capital was scarce, and running only a single store was possible. I do think that at a different time, in a different place, she could have built a much larger franchise,” says Hardika Shah, the founder and CEO of Kinara Capital.

This thought remained in Hardika’s mind throughout her 20s and 30s as she navigated life and found her footing as a management consultant in Silicon Valley. Growing up in Mumbai in a middle class family, her life and upbringing was far from ordinary.

While her mother owned a small business, her father, who is blind, taught at a women’s college. They challenged societal conditioning and traditional roles, and battled against all odds to give their two girls everything they needed to fulfil their dreams — even if that involved and moving to a smaller apartment to fund Hardika’s undergraduate education in the US.

Besides supporting his own daughters, Hardika’s father also provided monetary aid to blind schools by sponsoring braille printers. The concept of giving back and its social impact was drilled into her. As an adult, when she found out about social entrepreneurship as an adult, she found the missing puzzle piece.

Then after 23 years of being in the US, she returned to India in 2011 to launch Kinara Capital. It provides unsecured loans to Micro, Small and Medium-sized Enterprises (MSMEs) within 24-48 hours and has helped over 1,25,000 business owners so far. Her vision was to provide capital to small business owners so that everyone could expand their ventures.

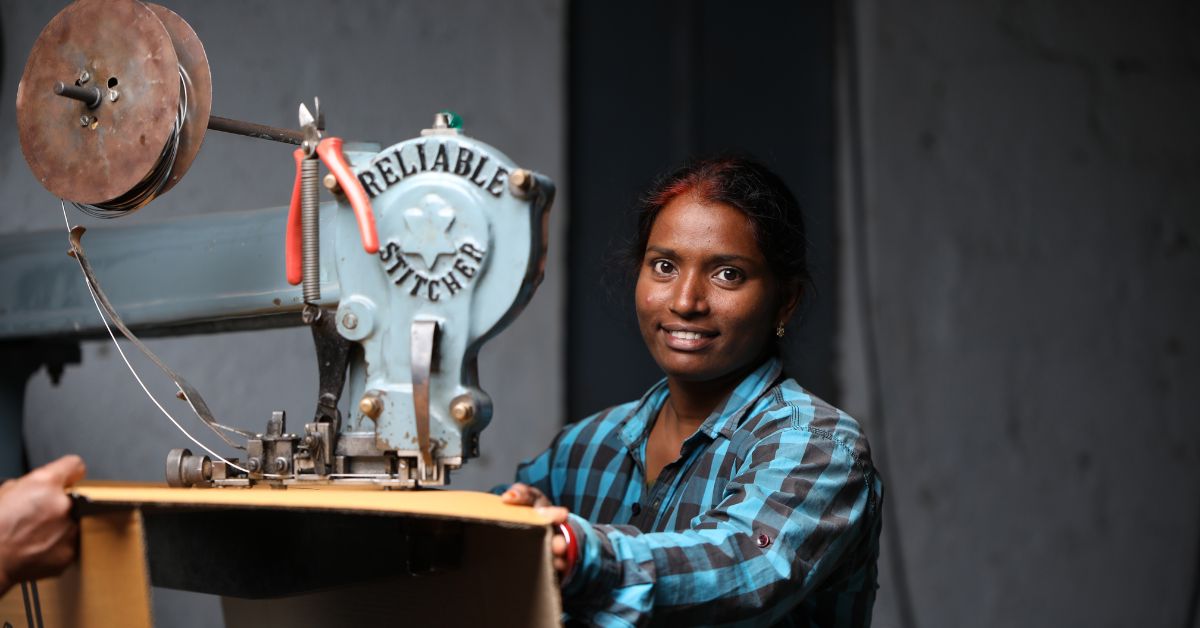

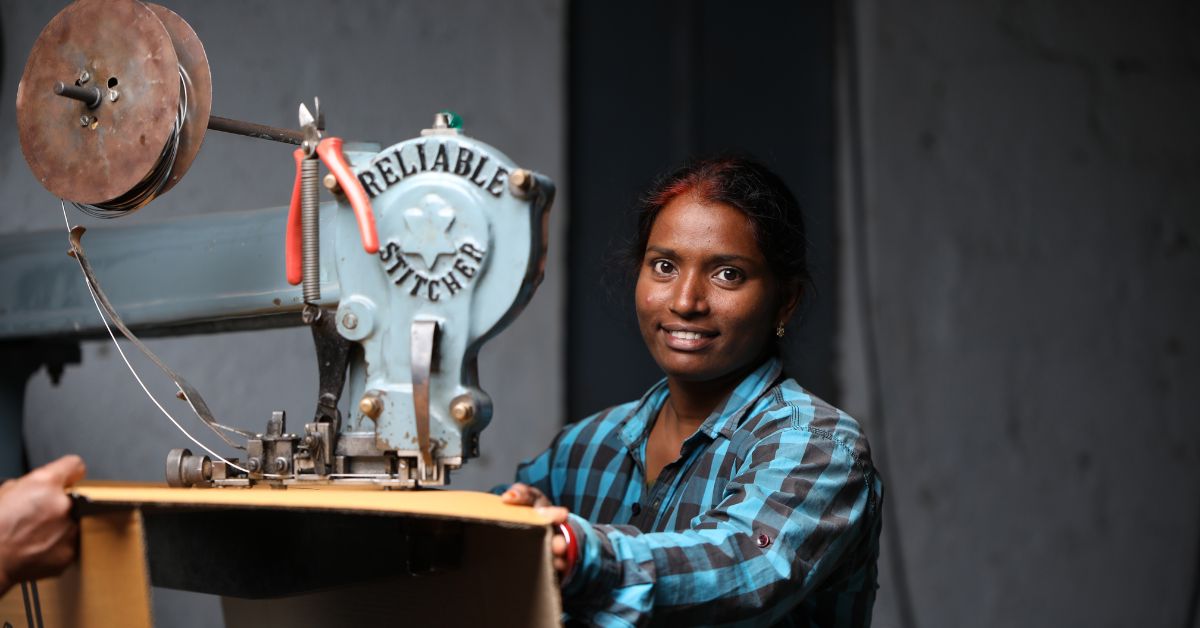

Her business has a special focus on women, be it in their personal team, where almost 60 percent top management are women, or through their ‘HerVikas’ programme, that provides discounted business loans for women-owned MSMEs to help them take their businesses to the next level.

Here’s how Hardika built this business which has disbursed over Rs 6,760 crores so far.

After entering junior college, Hardika wasn’t too happy about the fact that she could only choose one subject to major in. She was interested in multiple subjects, and wished for a course that would allow her that liberty.

Kinara Capital targets the ‘missing middle’

During the same time, her father who taught political science, would frequent the American library in Mumbai. He used to take his daughters there from time to time. Here, Hardika came across the courses taught in American colleges.

“I discovered liberal arts, where you can study a wide range of subjects and still get a graduate degree. It was just what I wanted and after I learnt about it, it became my goal to pursue this course in the US,” Hardika tells The Better India.

Hardika’s upbringing was non-traditional in a lot of ways. Her mother had been ostracised by her family for her choice of partner and faced many struggles, yet the family chose to be happy and live a life full of love, happiness and dreams.

With her unconventional upbringing, her parents allowed her and her sister to dream big, work during junior college, have different life experiences and most importantly, go abroad for an undergraduate degree, which was quite unheard of then.

Hardika worked summers after finishing Class 10, where her first job was working as a market researcher for shampoo fragrances. After that, she worked as a font designer.

“Just before going to college, I had to create fonts for Indian languages on the computer. Since they wanted someone who could handle computers and had an artistic mind, I got the job and worked there for three months,” adds the

Hardika started Kinara Capital in 2011

While she managed her pocket money, raising funds for her undergraduate degree in the US was no mean feat. Hardika shares that she spent almost 18 months preparing for all the different exams, but mostly just trying to find avenues for her finances.

“It was really not cheap to go to the US in the 80s. Liberal arts colleges then gave some financial aid, but it was very limited,” she adds.

Her parents came to her rescue and sold their house to fund her education, moving to a smaller rented apartment.

The then teenager entered Knox College in Illinois, USA, where she pursued a BA in computer science. The degree gave her the opportunity to study everything from world history, anthropology, economics to symbolic logic apart from traditional subjects.

After her undergraduate degree, she worked at Accenture in Chicago, Singapore, Sydney, and then back again in the US in San Francisco in financial services, technology and consulting for almost 19 years.

Her work also brought her to India almost 10 years later, in the post liberalisation era. For someone working in the Silicon Valley, she found a stark difference and a big gap in accessibility that needed to be filled.

She then decided to spend her weekends every summer as a social impact business mentor.

“I would spend time with entrepreneurs across the world, including India, and help them develop their business ideas, models and also face related challenges,” she adds.

She followed this mentorship up with an executive MBA at the University of California, Berkeley, Haas School of Business. She noticed a pattern in the challenges faced by people in India, and one recurring challenge emerged — access to capital.

“I spent three months in India with bankers, techies, and self-help groups to understand where the gap in access to capital lay before starting Kinara. After all, micro finance and Non-Banking Financial Companies (NBFCs) had expanded very well in the country by then, and were able to meet the needs of people in rural India,” adds Hardika.

Kinara Capital has disbursed over 1.2 lakh loans so far

The major credit gap, the consultant found, was in the ‘missing middle’, of people in need of loans in the range of Rs 1 lakh to Rs 10 lakh.

Meeting these small business owners, SHGs, women entrepreneurs, led to a deja vu moment.

Didn’t her mother face the same problem 25 years back? Why was no one able to fix this for this income group, wondered Hardika.

Determined to ensure that no one should have unfulfilled dreams due to lack of capital like her mother, the 53-year-old decided to solve the problem. Providing collateral was a major problem in this bracket, which she solved through Kinara Capital by providing unsecured loans.

“The biggest gap across tier 1, 2 and 3 cities was unsecured business lending, as most of the borrowers don’t have land or property to offer as collateral. I decided to focus on people in these cities who are on the fringe of inclusion,” she adds.

With Kinara Capital’s launch in 2011, Hardika raised funds from social impact investment funds like Michael & Susan Dell Foundation, Patamar Capital, Gaja Capital, British International Investment (BII) and more.

Kinara Capital runs HerVikas to help women entreprenuers

Kinara vets its customers with the help of AI and Machine learning, with the last mile delivery done by its officers. They have 133 branches across 100 cities in the country, and have disbursed over 1,25,000 loans so far, with assets under management of over Rs 3,170 crores.

The interest rates range from 20 to 32 percent on a reducing balance basis, with the average tenure ranging from 36 to 38 months.

“Our underwriting is 95 percent digital and 5 percent physical, through our sales officers on ground. It’s a blended tech model with a physical branch network where most of the underwriting and collections are done online,” adds the social entrepreneur.

She says that 20 percent of their monthly disbursements go to existing customers, helping them grow their businesses.

One of Kinara’s clients, Divya explains how the company’s policy helped her.

She runs a company called Brookwoods Technologies in Bengaluru, and wanted to take a loan for her business. Since her business was less than a year old, most lenders refused.

“Most NBFCs and banks lend after a business completes three years of operations. Kinara didn’t have such conditions and gave us a loan, which helped us immensely. The entire process was streamlined and online. An officer from their team came for inspection and sanctioned the loan very quickly,” she says.

Divya has been able to grow her company to a turnover of Rs 3 crores in 3 years.

Through all this, Hardika states that Kinara is profitable today and rearing to reach more business owners.

The reason for Kinara’s existence began thanks to a woman entrepreneur, and hence it’s a no-brainer that their HerVikas programme, which offers discounts to women entrepreneurs to boost their businesses, remains successful.

The programme has disbursed Rs 700 crores in the past 5 years, offering a 1 percent interest discount, 60 day repayment holiday, 50 reduction in processing fees.

With a 3.5 percent to 4 percent Non-Performing Asset (NPA) rate, Hardika wants to reach more MSMEs in the coming years, hoping to reach 2 lakh additional customers in the next 3 years.

“There is a notion that unsecured business lending is risky and customers will disappear with your money. Our numbers prove that this is so far away from the truth. Customers are grateful to have access to capital and repay on time. They also use the money judiciously to grow their businesses,” she says.

Going forward, she hopes to enhance more jobs by reaching more small businesses. She doesn’t want any business owner with potential to lose out because of lack of access to capital.

“My mother could have been a big franchise owner had Kinara been present then. Let no other lose out on their potential due to lack of access to capital. Let there be no regrets, ifs and buts,” says Hardika.

Edited by Padmashree Pande, Images Courtesy Kinara Capital

This thought remained in Hardika’s mind throughout her 20s and 30s as she navigated life and found her footing as a management consultant in Silicon Valley. Growing up in Mumbai in a middle class family, her life and upbringing was far from ordinary.

While her mother owned a small business, her father, who is blind, taught at a women’s college. They challenged societal conditioning and traditional roles, and battled against all odds to give their two girls everything they needed to fulfil their dreams — even if that involved and moving to a smaller apartment to fund Hardika’s undergraduate education in the US.

Besides supporting his own daughters, Hardika’s father also provided monetary aid to blind schools by sponsoring braille printers. The concept of giving back and its social impact was drilled into her. As an adult, when she found out about social entrepreneurship as an adult, she found the missing puzzle piece.

Then after 23 years of being in the US, she returned to India in 2011 to launch Kinara Capital. It provides unsecured loans to Micro, Small and Medium-sized Enterprises (MSMEs) within 24-48 hours and has helped over 1,25,000 business owners so far. Her vision was to provide capital to small business owners so that everyone could expand their ventures.

Her business has a special focus on women, be it in their personal team, where almost 60 percent top management are women, or through their ‘HerVikas’ programme, that provides discounted business loans for women-owned MSMEs to help them take their businesses to the next level.

Here’s how Hardika built this business which has disbursed over Rs 6,760 crores so far.

Seeds of social entrepreneurship

After entering junior college, Hardika wasn’t too happy about the fact that she could only choose one subject to major in. She was interested in multiple subjects, and wished for a course that would allow her that liberty.

Kinara Capital targets the ‘missing middle’

During the same time, her father who taught political science, would frequent the American library in Mumbai. He used to take his daughters there from time to time. Here, Hardika came across the courses taught in American colleges.

“I discovered liberal arts, where you can study a wide range of subjects and still get a graduate degree. It was just what I wanted and after I learnt about it, it became my goal to pursue this course in the US,” Hardika tells The Better India.

Hardika’s upbringing was non-traditional in a lot of ways. Her mother had been ostracised by her family for her choice of partner and faced many struggles, yet the family chose to be happy and live a life full of love, happiness and dreams.

With her unconventional upbringing, her parents allowed her and her sister to dream big, work during junior college, have different life experiences and most importantly, go abroad for an undergraduate degree, which was quite unheard of then.

Hardika worked summers after finishing Class 10, where her first job was working as a market researcher for shampoo fragrances. After that, she worked as a font designer.

“Just before going to college, I had to create fonts for Indian languages on the computer. Since they wanted someone who could handle computers and had an artistic mind, I got the job and worked there for three months,” adds the

Hardika started Kinara Capital in 2011

While she managed her pocket money, raising funds for her undergraduate degree in the US was no mean feat. Hardika shares that she spent almost 18 months preparing for all the different exams, but mostly just trying to find avenues for her finances.

“It was really not cheap to go to the US in the 80s. Liberal arts colleges then gave some financial aid, but it was very limited,” she adds.

Her parents came to her rescue and sold their house to fund her education, moving to a smaller rented apartment.

The then teenager entered Knox College in Illinois, USA, where she pursued a BA in computer science. The degree gave her the opportunity to study everything from world history, anthropology, economics to symbolic logic apart from traditional subjects.

After her undergraduate degree, she worked at Accenture in Chicago, Singapore, Sydney, and then back again in the US in San Francisco in financial services, technology and consulting for almost 19 years.

Her work also brought her to India almost 10 years later, in the post liberalisation era. For someone working in the Silicon Valley, she found a stark difference and a big gap in accessibility that needed to be filled.

She then decided to spend her weekends every summer as a social impact business mentor.

“I would spend time with entrepreneurs across the world, including India, and help them develop their business ideas, models and also face related challenges,” she adds.

She followed this mentorship up with an executive MBA at the University of California, Berkeley, Haas School of Business. She noticed a pattern in the challenges faced by people in India, and one recurring challenge emerged — access to capital.

Finding the missing piece of the puzzle

“I spent three months in India with bankers, techies, and self-help groups to understand where the gap in access to capital lay before starting Kinara. After all, micro finance and Non-Banking Financial Companies (NBFCs) had expanded very well in the country by then, and were able to meet the needs of people in rural India,” adds Hardika.

Kinara Capital has disbursed over 1.2 lakh loans so far

The major credit gap, the consultant found, was in the ‘missing middle’, of people in need of loans in the range of Rs 1 lakh to Rs 10 lakh.

Meeting these small business owners, SHGs, women entrepreneurs, led to a deja vu moment.

Didn’t her mother face the same problem 25 years back? Why was no one able to fix this for this income group, wondered Hardika.

Determined to ensure that no one should have unfulfilled dreams due to lack of capital like her mother, the 53-year-old decided to solve the problem. Providing collateral was a major problem in this bracket, which she solved through Kinara Capital by providing unsecured loans.

“The biggest gap across tier 1, 2 and 3 cities was unsecured business lending, as most of the borrowers don’t have land or property to offer as collateral. I decided to focus on people in these cities who are on the fringe of inclusion,” she adds.

What sets Kinara Capital apart?

With Kinara Capital’s launch in 2011, Hardika raised funds from social impact investment funds like Michael & Susan Dell Foundation, Patamar Capital, Gaja Capital, British International Investment (BII) and more.

Kinara Capital runs HerVikas to help women entreprenuers

Kinara vets its customers with the help of AI and Machine learning, with the last mile delivery done by its officers. They have 133 branches across 100 cities in the country, and have disbursed over 1,25,000 loans so far, with assets under management of over Rs 3,170 crores.

The interest rates range from 20 to 32 percent on a reducing balance basis, with the average tenure ranging from 36 to 38 months.

“Our underwriting is 95 percent digital and 5 percent physical, through our sales officers on ground. It’s a blended tech model with a physical branch network where most of the underwriting and collections are done online,” adds the social entrepreneur.

She says that 20 percent of their monthly disbursements go to existing customers, helping them grow their businesses.

One of Kinara’s clients, Divya explains how the company’s policy helped her.

She runs a company called Brookwoods Technologies in Bengaluru, and wanted to take a loan for her business. Since her business was less than a year old, most lenders refused.

“Most NBFCs and banks lend after a business completes three years of operations. Kinara didn’t have such conditions and gave us a loan, which helped us immensely. The entire process was streamlined and online. An officer from their team came for inspection and sanctioned the loan very quickly,” she says.

Divya has been able to grow her company to a turnover of Rs 3 crores in 3 years.

Through all this, Hardika states that Kinara is profitable today and rearing to reach more business owners.

The reason for Kinara’s existence began thanks to a woman entrepreneur, and hence it’s a no-brainer that their HerVikas programme, which offers discounts to women entrepreneurs to boost their businesses, remains successful.

The programme has disbursed Rs 700 crores in the past 5 years, offering a 1 percent interest discount, 60 day repayment holiday, 50 reduction in processing fees.

With a 3.5 percent to 4 percent Non-Performing Asset (NPA) rate, Hardika wants to reach more MSMEs in the coming years, hoping to reach 2 lakh additional customers in the next 3 years.

“There is a notion that unsecured business lending is risky and customers will disappear with your money. Our numbers prove that this is so far away from the truth. Customers are grateful to have access to capital and repay on time. They also use the money judiciously to grow their businesses,” she says.

Going forward, she hopes to enhance more jobs by reaching more small businesses. She doesn’t want any business owner with potential to lose out because of lack of access to capital.

“My mother could have been a big franchise owner had Kinara been present then. Let no other lose out on their potential due to lack of access to capital. Let there be no regrets, ifs and buts,” says Hardika.

Edited by Padmashree Pande, Images Courtesy Kinara Capital